A dividend is a payment made by a corporation to its shareholders that is decided by the board of directors. Dividend payments are frequently made quarterly and might take the form of cash payments or stock reinvestments.

The dividend yield, which is the dividend per share, is stated as a percentage of the share price of a corporation, for example, 2.5%. If a common shareholder of a dividend-paying company owns the shares on the ex-dividend date or earlier, they are eligible to receive a payment. By using their voting powers, shareholders must approve dividends.

Despite the fact that stock dividends are less prevalent than cash dividends, they are still a possibility. Different exchange-traded funds (ETFs) and mutual funds also distribute dividends. A dividend is a payment made to shareholders as compensation for their equity investment in a firm, and it typically comes from the latter’s net profits.

While some profits may be retained by the business to be used for current and future operations, the remaining may be distributed to shareholders as a dividend.

How do the dividends work?

Even when they don’t generate enough earnings to continue their proven track record of payouts, companies may nevertheless pay dividends. The board of directors has the option to declare dividends at various intervals and at varied distribution rates. Dividends may be paid on a regular basis, such as once a month, once every three months, or once a year. For instance, Walmart Inc. (WMT) and Unilever (UL) consistently pay dividends on a quarterly basis.

Non-recurring special dividends can also be paid out by companies, either separately or in addition to a regular payout. A special dividend of 10 cents per share was announced by United Bancorp Inc. The transfer of company profits to qualified shareholders is known as a dividend. The directors of a firm decide on dividend payments and quantities. The dividend yield is the dividend per share, calculated as a proportion of the share price of a corporation.

Many businesses choose to keep their earnings in order to reinvest them back into the business rather than paying dividends. The top dividend payers are frequently larger, more established businesses with reliable revenues, and the following industry categories consistently track dividend payments: Companies organized as real estate investment trusts (REITs) and master limited partnerships (MLPs) are required to make specific distributions to shareholders.

Continual dividend payments may also be made by funds in accordance with their declared investment objectives. Startups, such as those in the technology or biotech industries, may not provide monthly dividends because these businesses may still be in the early stages of development and use earnings for operational, business expansion, and R&D purposes.

How to check dividends received in Zerodha?

How to check dividends received in Zerodha?

- Utilize your login information to access your Zerodha account.

- Go to Section 3 of the Profile. From the Console menu, select Portfolio.

- Tap View Dividends after selecting the desired stock. You may find the stock’s dividend history there.

- Open the Dashboard on your Zerodha Console. Select Holdings from the Portfolio menu at the top.

- Select the stock for which you wish to study the dividend history Hover the mouse pointer over the stock’s name and choose Options (the dots).

- To view the dividend history, click View dividends received.

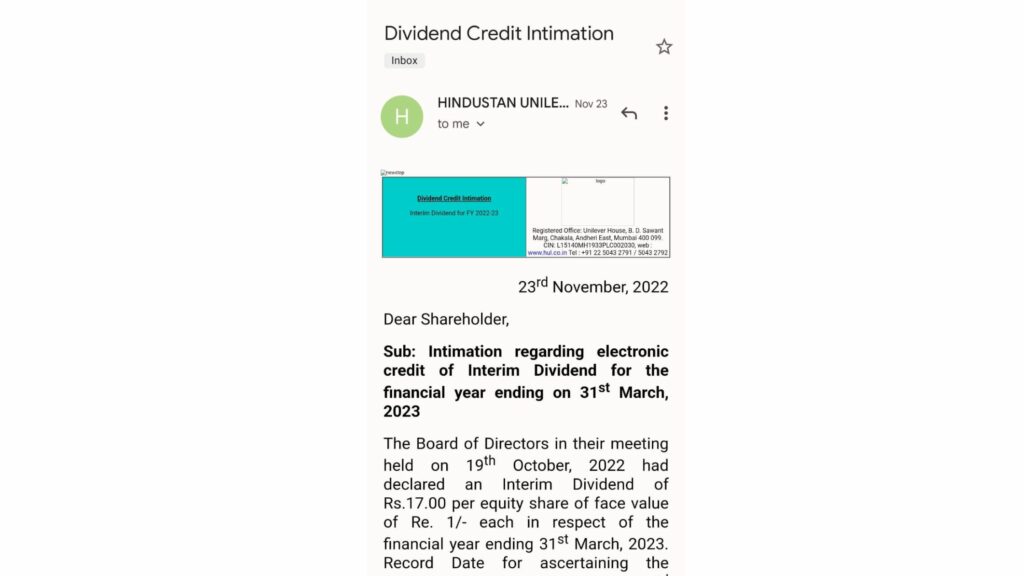

PLEASE NOTE: You must receive an email from the dividend-paying company that you are getting dividends with all tax information. As an example just take a look at the screenshot below:

So, that is how you can check the dividends received in Zerodha.

Check dividends received in Zerodha

Although one can see the dividend history through Kite mobile or Zerodha console, the dividend money is directly credited into the bank account associated with the Demat account. The P&L report, which can be downloaded from the Reports area after logging into the Zerodha Kite or console platform, can also be used to view history.

Retained profits, which are accumulated when a business generates a profit, can either be reinvested in the business or paid out as a dividend to shareholders. It’s possible for dividends to take the form of comparable shares in addition to cash.

The bulk of cheap brokers, however, do not offer the ability to view dividend history. Dividends are declared by the company’s management on the declaration day, and before they can be paid, the shareholders must approve them.

The ex-date, sometimes known as the ex-date, is the day on which dividend eligibility ends. For instance, stockholders who purchase a stock on or after the ex-date will not be eligible to collect the dividend.

More Articles:

- How to Change Bank Account in Zerodha?

- How to Buy Shares in Zerodha for the Long Term?

- What is TPIN in Zerodha? (Detailed Guide)

- What is IOC in Zerodha?

- How to Earn Money Fast in India with Zerodha Kite

- Top 10 Dividend-Paying Stocks You Should Know (2023 Edition)

- How to Delete a Upstox Account? (Do it Quickly!)