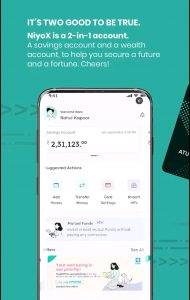

NiyoX Review: NiyoX, an Indian Neo-Banking pioneer and Equitas Small Finance Bank founder, was created to simplify banking. It eliminates all confusion in banking and makes managing finances easier, safer, and more efficient. NiyoX’s neo-banking app is quick and easy to use for recent college graduates.

NiyoX, the first product of its kind in quite a while, offers a 2-in-1 savings/wealth management arrangement. This will give you both dependability as well as support to achieve your savings goals. There is no need to maintain two separate apps for managing your finances. The integrated app eliminates the need for KYC separate to your mutual asset investment account. Although KYC can be a difficult process, NiyoX One e-KYC is able to apply to both your wealth and savings accounts.

What ID proof and address proof documents are required to create a NiyoX account?

You will need your:

- PAN Card

- Aadhaar Card

They will be able to verify your KYC and get their data. For opening an advanced account, this is also a requirement from the accomplice bank.

During the process of opening your web-based savings account, we will send you an OTP. You will receive the OTP via your registered mobile number with your Aadhaar.

NiyoX Bank Review: Account Fees

NiyoX is a company that decodes banking for recent college graduates with the ‘007’ bundle.

- 0% commission on mutual asset investments.

- There are no account maintenance fees, which is equivalent to a zero-balance savings account.

- Account balances up to 7%* Interest.

How do I create a NiyoX Bank account?

NiyoX makes it easy to open a bank account. Simply follow these steps:

1. Get the NiyoX App from Google Play Store or App Store

2. Register using your mobile number or email address

3. You can verify your identity by completing your virtual KYC (Know Your Customer).

4. Fill in your data.

Once you have downloaded the app, the onboarding process is very simple and straightforward. This will help you open your NiyoX bank account and get started with your neobanking venture in just seconds. Follow these steps to get started with your zero balance savings account.

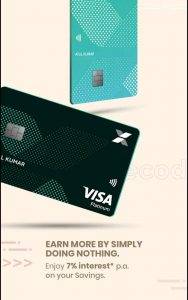

NiyoX Review: Interest Rate

Who doesn’t want their money to exceed all expectations? Your savings account balance of more than Rs.1 lakh will earn you an industry-leading 7% interest per annum. For more information:

A savings account balance up to Rs1 lakh earns interest at 3.5% p.a.

A steady sum of Rs1 lakh or more yields 7% per annum.

This will result in steady, but delicate growth of your savings. If you have a Rs1,10,000 savings account, you’ll get 3.5% on Rs15,000 and 7% for Rs10,000 more. NiyoX also promises a Rs0 account maintenance fee, so there is no cost for you to not keep an AMB (normal monthly balance) of Rs10,000.

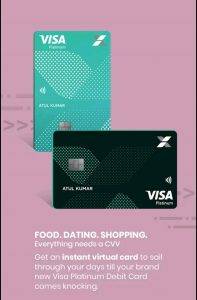

NiyoX Review: Debit Cards Charges

A computerized debit card is also available. You can also arrange a customized Platinum Visa Debit Card. To get started with neobanking, you can simply download the NiyoX App!

The Platinum Debit card comes with an annual fee Rs150 + GST. You can still get the current promotional offer until 31 March 2022. This will postpone your first year’s annual fees. Get your card today!

NiyoX Review: Contact Number of NiyoX and Email ID

For Niyo/Global

For Bharat

For SME:

Register at NiyoX

Bengaluru, IN (HQ)

Ground Floor Alpha Block, Sigma Technology Park

NiyoX Founders

Vinay Bagri (Cofounder and CEO) – Vinay spent 18 years working in corporate America with various associations such as Parle, 3M and ICICI Bank. Standard Chartered, ING and Kotak Mahindra Bank are just a few of the many organizations Vinay worked for. Niyo is known for his customer-focused approach. “We are paranoid about ensuring that the user has a positive experience and value.”

Virender Bisht, Founder and Chief Technology Officer – Virender has 16 years experience in the development of software products. Viren has seen both the positive and the negative aspects of corporate culture. He sees Niyo’s core values as a way for the association to stay grounded. They are a reflection of what an ideal organization should look.

NiyoX App Details (iOS & Android)

The NiyoX Android app can be downloaded here

The NiyoX iOS app can be downloaded here

Referral code for NiyoX and cash rewards

Referral Program allows you to welcome your companions to NiyoX. Each member can receive up to Rs.125. Your companion must open a Niyo Equitas Account with your Referral Code, and make a transaction > Rs 999. You and your companion will receive scratch cards as a reward. Refer your friends and receive up to five scratch cards.

How to use the Niyox App Referral Code for Cashback?

1. Install & Open the app.

2. Register for a New Account —> Use my Referral Code from Niyox.

3. Apply and create a bank account

4. You will receive Rs 125 cash rewards

5. You Need Aadhar Card, Pan Card for Making Niyox Bank Account

6. That’s all.

Instructions for creating your own Niyo Referral Code to Earn Unlimited Cash Reward

- Open Niyox App.

- Login to the App.

- Click on Reward to Go to the Menu.

- You will receive your own Niyox Referral code.

- Share this code with friends when your friend creates an account.

- Get a Free Cash Reward

NiyoX Rewards Points

You can also earn Equinox Reward points for all store moves, and any POS or internet business purchases made with your debit card. These Equinox Points may be used to purchase exclusive products.

NiyoX is your partner in money development.

Final Thoughts: NiyoX Review

Although NiyoX digital bank promises some impressive computerized banking benefits it is really lacking in customer support. A few customers complained about a slow and delayed customer service response. A few customers have also complained about their registered number being hampered by customer support. This was even after they exchanged assets to their Niyo global forex card. Others feel that NiyoX forex cards can be more expensive than customary forex cards if INR is worth less than USD by Rs.2 or more.

NiyoX accounts offer access to more than just a savings account. Niyo Money’s comprehensive wealth management suite offers zero commission mutual assets, an account to track all your investments at once, a Robo advisory and an element that examines your savings and investment. Niyo Money will soon be able to dispatch domestic and international stocks through the platform.

FAQs – NiyoX – The Digital Banking App

1. What kind of account is it?

This account is 2 out of 1. Equitas Small Finance Bank is the organization that manages the Savings Bank Account. The Zero Commission Mutual Fund Platform is powered by Niyo Money. The Niyo Equitas savings bank account is a “ZERO” account. This means that there is no requirement to maintain a predetermined month-to-month account balance.

2. Who can apply for a NiyoX Account?

All Indian occupants over 18 years old can open a NiyoX account.

3. How safe is NiyoX Digital Savings?

Equitas Small Finance Bank provides this Savings account and follows all administrative rules set by the Reserve Bank of India. Your money is covered up to Rs 5 Lakh under the ‘Deposit Insurance and Credit Guarantee Corporation’. This is a fully claimed auxiliary of Reserve Bank of India. This is to protect depositors.

4. What documents are required to complete KYC?

They will need your PAN card and Aadhaar card numbers. An OTP (sent to your Aadhaar registered mobile/telephone number) and other data close to home will also be required.

5. How many nominees can I add to my NiyoX savings accounts?

One nominee can be added.

You get your industry-wellbeing rate. This allows you to make more money for the work you do. You can earn rewards with every ECom/POS/UPI trade. We know you love to be unique and show your style. To get started with neobanking, you can simply download the NiyoX App from the Google Play Store!