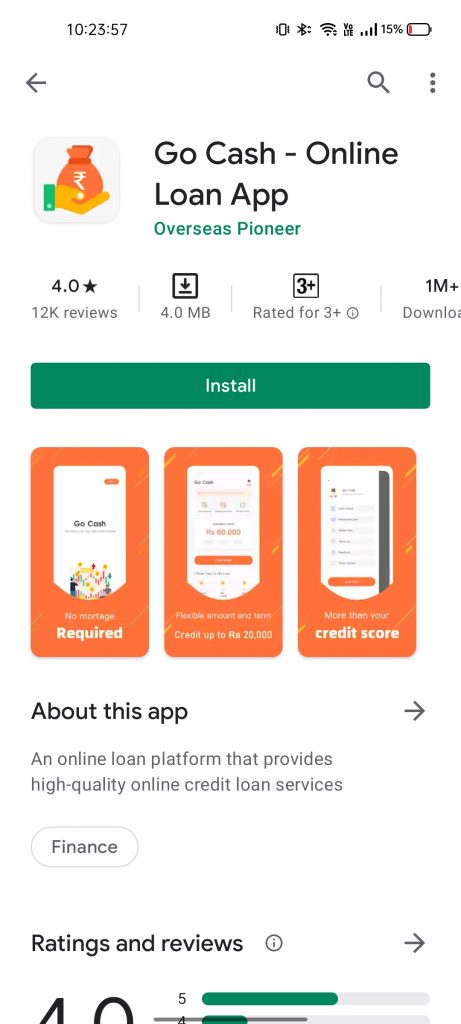

Go Cash – The Instant Loan App in India: The name of the app that we are moving to talk about in this post today is Go Cash, the instant personal loan app which is currently available in the Google Play Store. In this one of the very important articles about instant loans, we are going to tell you about an app from which you can take an instant loan in just within minutes and also tell you how you can take a loan from it without any hassles or issues.

Read: Go Cash Loan App is Real or Fake?

Go Cash: A Complete In-Depth Review

Get to know almost everything in this in-depth post about Go Cash. If you have any complaints or queries, do let us know by contacting us through this contact form. If you need more details, just comment below. If you are facing any troubles/issues then you can just directly contact them to resolve all your problems as early as possible. You can also submit/send your complaints here.

What is Go Cash – The Instant Online Loan App?

In Google Play Store they mentioned that – Go Cash is an online loan app and it provides online credit loan services in India. Go Cash is a mobile online loan platform that gives high-quality online credit loan benefits for Indian users.

Let us tell you that what we are going to instruct in this article, what is the news that will be very beneficial for you if you are going to take loans from this Go Cash loan app. Which we all know is one of the decent Indian instant loan app companies available in the Play Store and App Store (check if it’s still available or not).

Read: Go Cash Customer Care Number, Toll-Free Number, and Office Address

We are also bound to share what kind of loan or what types of loan you can take from this Go Cash – Instant loan app and much more input that will be crucial for you before taking a loan from this app today. We request you all to thoroughly read this article to the edge so that you can get complete news and information so that no question remains in your thoughts.

Now, we are giving you data about how much loan you can take from this Go Cash loan app. That means how much instant loan will the Go Cash loan app company give you if you apply for a loan from this app or its platform. Know how much the Go Cash loan app can give you, the minimum and the maximum loan amount.

Some significant talks that we are going to say are: how much interest rate will you get from this Go Cash loan app. If you are going to take a loan from this Go Cash Loan App company, then at what rate of interest this company will give you a loan. If you are going to take from this Go Cash Loan App company, then what documents are you going to need like this Go Cash Loan app company can give you a loan only when documents are accessible for it.

How much time is going to be given to repay the loan proportion given to you by this company? In easy and simple language, how much tenure rate is going to cost you the Go Cash loan instant loan app. Which eligibility criteria do you have to fulfil by this instant loan app. If you do not meet just one of the eligibility criteria of this company, then this company will not give you a loan, this company will refuse to give you the loan and will only waste your time. Therefore, you will have to comply with all the circumstances.

Read: ThopTV APK download Customer Care Number | Customer Complaints | Email | Office Address

Go Cash Loan Interest Rate: It is the most important thing to check and consider before taking any kind of loan. Android Play Store is full of instant loan apps (some are legit and some others are just a scam), which are giving people quick and easy loans with minimum documentation or some apps without any documentation (they are just making use of the CIBIL and Experian or CRIF score).

It is an instant loan program that provides quick and easy online credit loan services for Indian customers. Amount Range: ₹2000 – ₹20000. Credit days: 90-180 days. Repayment Period Available: Weekly, Fortnightly, or Monthly. Reducing Annual Interest Rate: 21-27% daily compounding. Annual Fee for their technology: 3% of the approved credit limit.

Read: PPmoney Customer Care Number | Customer Complaints | Email | Office Address

- How much loan will this Go Cash loan app company give?

For your information, let us tell you, you’ll get a loan of ₹ 2,000 to ₹ 20,000 through this Go Cash Loan App. That is, if you would like to use for a loan, then you ought to a minimum of ₹ 2,000. And if you would like to need a loan from this personal loan app then you’ll get a loan up to ₹ 20,000 from here. Which may be a decent percentage for the loan.

Now, you’ve got come to understand that what proportion loan you’re getting to get from this Go Cash loan app, now it becomes necessary for you to comprehend that if this app is supplying you with a loan then what proportion interest loan. This loan app won’t be supplying you with, you ought to not be deprived within the name of interest.

Read: Rashmika Mandanna Phone Number | WhatsApp Number | Email ID | Home | Office Address

- How much interest are you going to get from the Go Cash loan app?

For your information, let me tell your friends if you get a loan from Go Cash Loan App, the rest apply for your phone, then you are going to get an interest rate of 10% to 28% from this company. That is, if the company provides you with any people, then you are going to charge an interest fee at the rate of 10% to 28%.

Now you have come to know that, how many days are you going to get from this Go Cash loan app company, now it is also necessary for you to know that the interest rate you are going to get through Go Cash Loan App company documents You will get it only after that, that is, what documents are you going to need to take a loan from this app.

Read: Go Cash Loan Interest Rate: Check Here

- Which documents will you need for Go Cash Loan App?

What do you have to do with the Go Cash loan app with the Aadhaar card? The answer is – it will act as ID proof for you. On the other hand, you need a PAN card on the Go Cash loan app. With the help of a PAN card, the company will know your credit score and some other important details which will help them decide they should give the loan to you or not. PAN is mandatory to get an instant loan from this app.

Now you have come to know what documents you will need if you are going to take a loan from this Go Cash Loan App company. Now we are going to tell you how much time it will take for this company to return the outstanding amount of loan which you have taken loan from.

Read: Go Cash कस्टमर केयर नंबर, टोल-फ्री नंबर और ऑफिस का पता

- How much tenure rate will you get with the Go Cash loan app?

If you want to take a loan from this company or if you are going to apply for a loan, then this instant loan app will give you how many days to return the outstanding amount of the loan. In other words, Go Cash is going to charge you the tenure rate if you take a loan from this platform. You will be given a time frame from 91 days to 180 days. That is, if you take a car loan from this company, then you get at least 3 months to pay to return the loan outstanding amount and a maximum of 6 months to return the loan outstanding amount.

Now you have come to know that how much time you are going to get through this Go Cash Loan App, now it is also necessary for you to know the terms and conditions of this app. If you provide any loan.

Read: Fast Cash Loan Customer Care Number, Toll-Free Number, and Office Address

- How to know if you are eligible for a Go Cash loan or not?

- You have to be an Indian citizen, if you are not a citizen of India, you are a citizen of any other country, then you will not get a loan through this app. So you have to make sure that you are a citizen of India.

- Your age should be between 21 years to 56 years. That is, if your age is less than 21 years, then you cannot apply for this loan, you will not get a loan from this organization. Even if your age is more than 56 years, you will not get a loan from the Go Cash loan app. So, you have to make sure that your age is in between 21 years to 56 years by checking your ID proof (Voter ID card or Aadhaar Card).

- You have to have some source of monthly income.

Go Cash: Ratings and Reviews

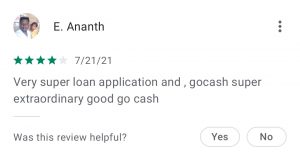

Go Cash: Positive reviews –

Nice app – Hanu R.

Good and easy to do the procedure and also processing easy and faster for new users thank you go the cash for giving this opportunity. – Mega Sundresan.

This was an excellent app for providing more help to them and the interest is must be controlling. – Manda Madhu.

Service is very important for me or any emergency for any other personal information is very important any emergency for your reference for processing fastest and confirm. -Vipin Kala.

Very super loan application and go cash super extraordinary good go cash. – E. Ananth.

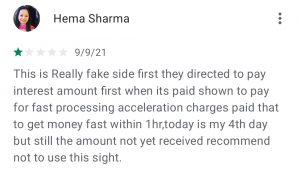

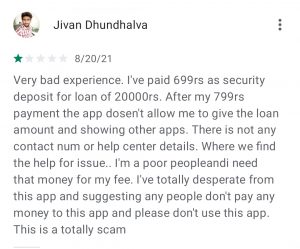

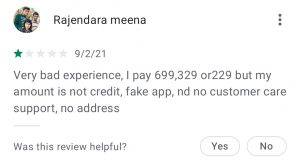

Go Cash: Negative reviews –

This is a fake side first they were directed to pay the interest amount first when it paid shown to pay for fast processing acceleration charges paid that to get money fast within 1hr, today is my 4th day but still the amount not yet received recommend not to use this site. – Hema Sharma.

Very bad experience. I’ve paid 699rs as a security deposit for 20000rs. After my 799rs payment, the app doesn’t allow me to give the loan amount and showing other apps. There are not any contact num or help centre details. Where we find the help for the issue. I’m personable and I need that money for my fee. I’ve been desperate for this app and suggesting any people don’t pay any money and please don’t use this app. This is totally a scam. – Jivan Dhundhalva.

Very bad experience, I pay 699, 329 or 229 but my amount is not credit, fake app, and no customer care support, no address. – Rajendara Meena.

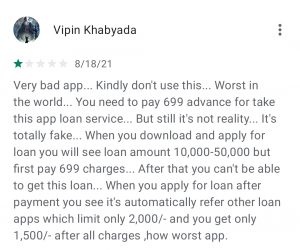

It’s a very bad app…Kindly don’t use this…Worst in the world…You need to pay 699 advances for taking this app loan service…But still, it’s not reality….it’s fake…when you download and apply for a loan you will see a loan amount of 10,000-50,000 but pay the first 699 charges…After that, you can’t be able to get this loan… When you apply for a loan after the payment you see it automatically refers to other loan apps which limit Rs.2000 and you get only Rs.1500 after all charges, how the worst app. – Vipin Khabyada.

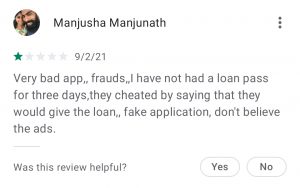

Very bad app. Frauds, I have not had a loan pass for three days, they cheated by saying that they would give the loan, fake application, don’t believe the ads. – Manjusha Manjunath.

So, in this post, we have discussed a lot of information on the personal loan app like what rate of interest you can take a loan from this app, genuine ratings and honest reviews and which documents are going to be required. and many more. If you liked this post then share it with your friends and family.

Some little advice on we would like to tell you that, without any emergency cases such as medical or others, do not take an instant loan or any other loan which will help you in the long-term. You will not ever become wealthy if you regularly take loans from banks or any NBFCs. Loans never make you rich rather it will make you poor if it is not utilized properly. So, it is always a good idea to think some time and ask yourself that is it necessary to take this loan? or I can manage it in some other ways.

Taking some cash from friends can also help you a lot. Therefore you will not have to pay any hefty interest charges and also make your relation with friends much better. But, remember to pay your friend on time as he/she is also a human being and need money any time.

Some tips you should follow after taking an instant loan from Go Cash:

- Take minimum loan amount.

- Pay your EMIs on time. So, it is beneficial for the company as well as your credit score.

- Close loan early if possible.

- Contact Go Cash customer care if you are facing any issues.

- Read the loan agreement thoroughly before accepting that.

- Know each detail of the company before applying for the loan.

Some contact details of this instant loan app:

- Company Name and Details: Go Cash – Instant Online Loan App.

- Contact Number / Phone Number: N.A.

- Toll-Free Number: N.A.

- Email Address: [email protected]

- Office Address: N.A.

More Articles:

- Complaint Letter to Police Station About Theft of Mobile Phone, Theft of Bike / Motorcycle or Wallet

- Media Rewards Customer Care Number | Customer Complaints | Email | Office Address

- मोबाइल फोन की चोरी, बाइक/मोटरसाइकिल या पर्स की चोरी के बारे में पुलिस स्टेशन को शिकायत पत्र

- PG Hospital (Kolkata) Phone Number, Contact Number, Address

- Hi-Tech Hospital, Bhubaneswar Contact Number | Patient Complaints | Email | Office Address

- Vansh Sayani Phone Number | Contact Number | WhatsApp Number | Email Address | House Address

- Kim Sharma Phone Number | Contact Number | WhatsApp Number | Email Address | House Address